Mutual funds are widely recognized as one of the most beneficial investing options since they help you smoothly achieve your financial goals. One of the most significant advantages of mutual funds is their tax efficiency as a means of investment. Mutual funds may provide tax-efficient returns. However, if you do not consider taxes, you may be investing in mutual funds incorrectly.

Because it could impact your cash flow, an investor should evaluate other issues in addition to taxation, such as taxation on dividends, redemption, etc. In addition, managing your investments to reduce your overall tax expenses can be eased by knowing the taxation of mutual funds.

Here we aim to provide you with information about mutual fund taxation, to help you make informed investment decisions.

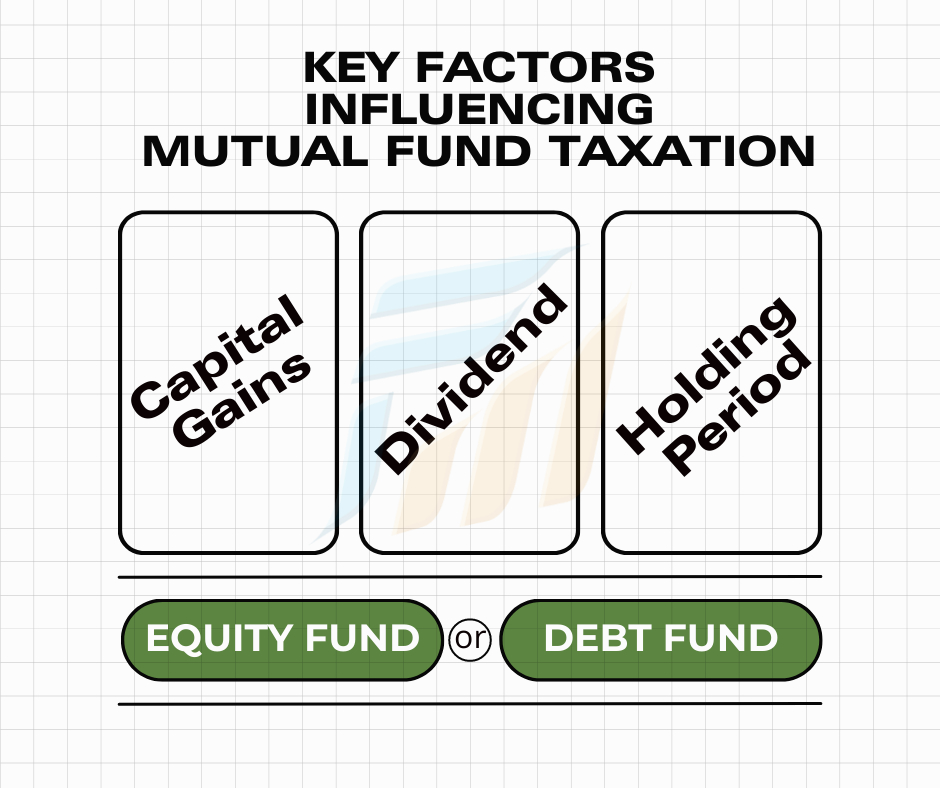

Key Factors Influencing Mutual Fund Taxation

Knowing how your mutual fund returns will be taxed is critical if you presently invest in them or intend to do so in the future. Gains and profits from mutual funds are taxable, just like those from the majority of other asset classes in which you invest. Capital gains from the selling of units are classified as short or long-term based on the holding duration.

4 Factors which affects taxation

- Type of Funds: Mutual Funds are classified into equity oriented and debt-oriented two categories for taxation purpose

- Capital Gains: These are profits generated when selling a capital asset for a higher price than its cost

- Dividend: Dividends are the distribution of profits accumulated by the Mutual fund Company to its investors.

- Holding Period: The duration for which an investor holds his investments also , influence the tax rate on capital gains.

Mutual fund investment allows investors to benefit from either capital gains or dividend income. Let us define them and analyse their differences in more depth.

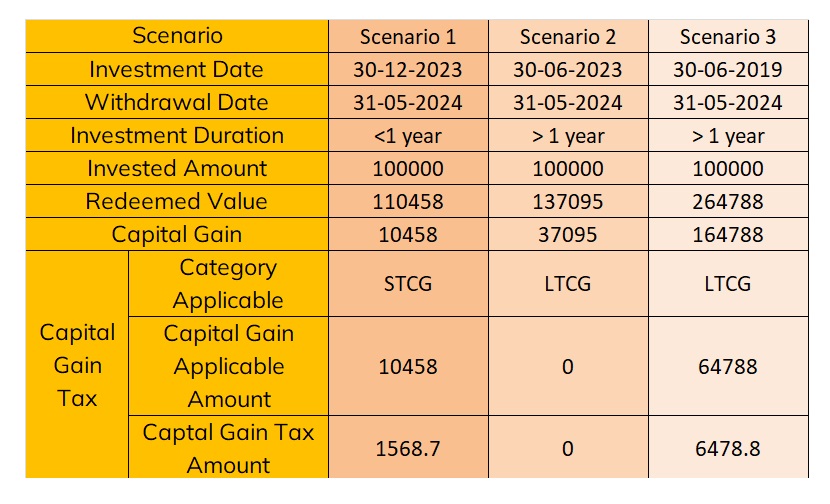

Capital Gains are the profits made when an asset is sold for more than its cost. However, it is important to remember that Capital Gains are only realized when the Mutual Fund units are redeemed. Hence the Capital Gains Tax on Mutual Funds is applicable only when redemption happens and hence the tax on mutual fund redemption must be paid when the income tax returns are filed.

Dividends are another way for mutual fund investors to obtain income from their investments. The mutual fund declares dividends based on its accumulated distributable surplus. Dividends are given to investors at the discretion of the fund and are taxed immediately upon receipt. As a result, when investors get dividends from their mutual funds, they are required to pay taxes on them.

Mutual Fund Tax Regulations

Taxation on Dividends

Following the Finance Act of 2020, which cancelled the Dividend Distribution Tax (DDT), dividend income from mutual funds became fully taxable in the hands of investors. TDS (Tax Deducted at Source) is applicable, with the Asset Management Company (AMC) deducting 10% if the total dividend paid exceeds Rs 5,000 in a fiscal year. Investors can claim this TDS when filing their taxes.

Taxation on Mutual Fund Capital Gains

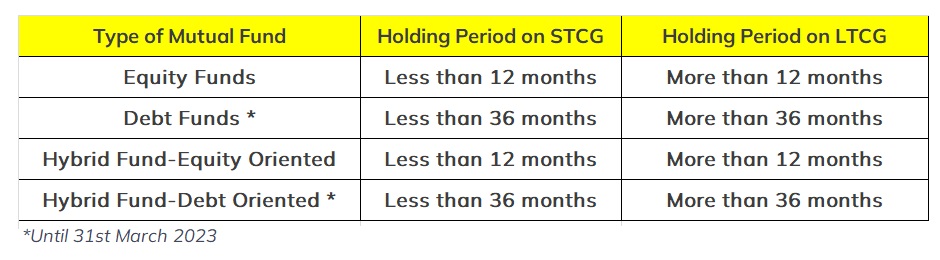

The type of MF scheme and the holding period impacts the tax on capital gains

Capital Gain based on the duration

There are two types of Capital Gain based on the duration – LTCG and Short-Term Capital Gains (STCG).

Scheme Orientation

After identifying your holding period, the taxation of capital gains depends on the MF category in which you have invested

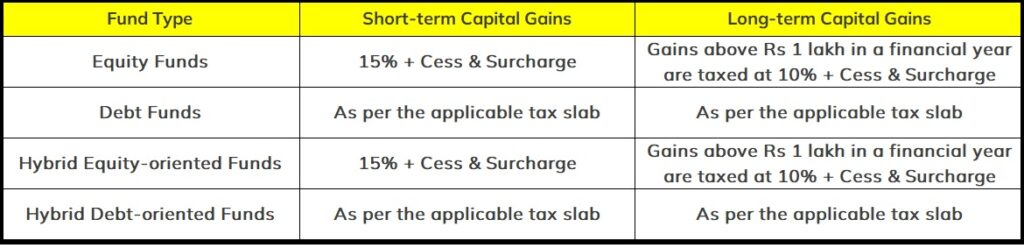

Taxation on Equity Funds

Equity funds invest over 65% of their assets in company equity. Short-term capital gains are taxed at a flat 15% rate, while long-term gains of up to Rs 1 lakh per year are tax-free, with excess gains taxed at 10%.

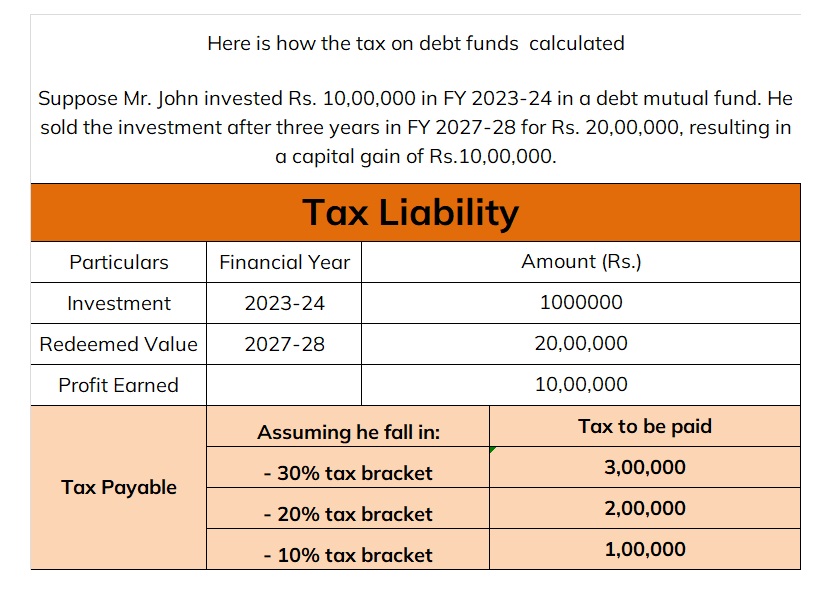

Taxation on Debt Funds

Starting April 1, 2023, there is no indexation benefit for debt funds and will be considered short-term capital gain. Gains from these funds will be treated as taxable income and will be taxed at the slab rate.

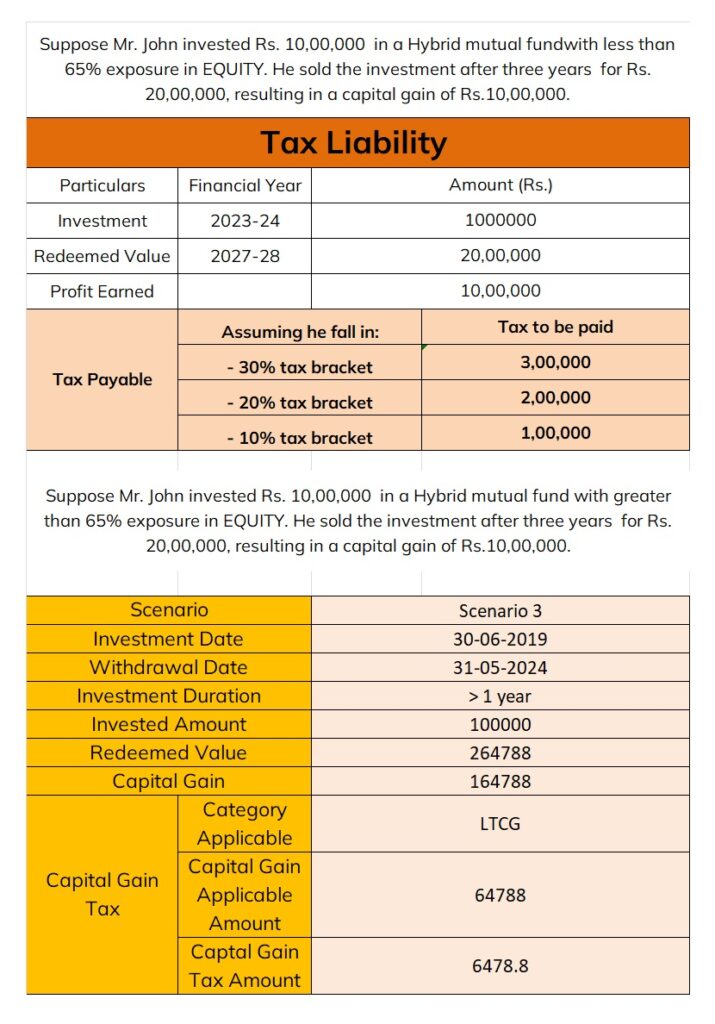

Taxation on Hybrid Funds

The taxation of capital gains on hybrid or balanced funds depends on the portfolio’s equity exposure. If it exceeds 65%, the scheme is taxed like an equity fund, otherwise, it follows debt fund taxation rules.

Taxation of Capital Gains in SIPs

Systematic investment plans (SIPs) are a method for investors to invest in mutual funds periodically, with the option to choose a frequency of weekly, monthly, quarterly, bi-annually, or annually. SIPs involve purchasing a certain number of mutual fund units through each instalment, with redemption processed on a first-in-first-out basis. Long-term capital gains on SIPs are held for over a year, with no tax if the gains are less than Rs 1 lakh. Short-term capital gains on SIPs are taxed at a flat 15% rate, with applicable cess and surcharge.

Securities Transaction Tax

In addition to taxes on dividends and capital gains, Securities Transaction Tax (STT) is levied on the purchase or sale of units of equity funds or hybrid equity-oriented funds. It is typically 0.001% of the transaction value, excluding debt fund transactions.

Disclosure of Mutual Fund Investments in IT returns

If Mutual fund investments are redeemed in a financial year it must be properly disclosed during Income Tax filing.

Conclusion

Investors must understand the taxation of Mutual Funds to avoid reduced returns after paying taxes. They can determine the advantages of long- and short-term investments in equity and debt funds by calculating tax rules. Investing in tax-saver funds can reduce tax obligations and corpus generation. Long-term investments may be more tax-efficient than short-term holding.

This blog is solely for educational purposes.Mutual Fund investments are subject to market risks, read the offer document carefully before investing