Starting a life together is an exciting journey filled with major milestones: getting married, buying a home, or starting a family. But beneath the romance, one topic can become a major source of stress: money. Studies consistently show that financial disagreements are a leading cause of relationship stress.

The good news? You can turn this challenge into a shared strength. Financial planning for young couples is about communication, transparency, and creating a shared roadmap to achieve your biggest dreams. Follow these essential tips to set yourselves up for a lifetime of financial success and peace of mind.

1.The Critical First Step: Transparent Money Talks

Each partner must lay their cards on the table. This means sharing:

- Income: Current salaries and any other sources of income.

- Debt: Educational loans, credit card balances, car loans, and personal loans.

- Assets: Savings account balances, retirement accounts , insurance etc

2. Uncover Your “Money Personality“

Are you a natural saver or a spender? Do you obsessively track every rupee, or do you prefer a “don’t ask, don’t tell” approach? Understanding your partner’s money mindset is essential for creating a financial system that doesn’t feel like a punishment to either of you.

3. Setting Shared Financial Goals (Short-Term vs. Long-Term)

Goals give your money purpose. As a couple, your priorities will likely include a mix of short-term (1-3 Years) and long-term goals (5+ Years). Assign a specific, realistic rupee amount and a timeline to every major goal. Instead of “Save for a house,” use “Save Rs 5,00,000 for a down payment in 4 years.“

4.Creating a Sustainable Budget (Your Joint Spending Plan)

Your budget is the tool that directs every rupee toward your shared goals. For young couples, one of the biggest questions is: Do we merge our bank accounts?

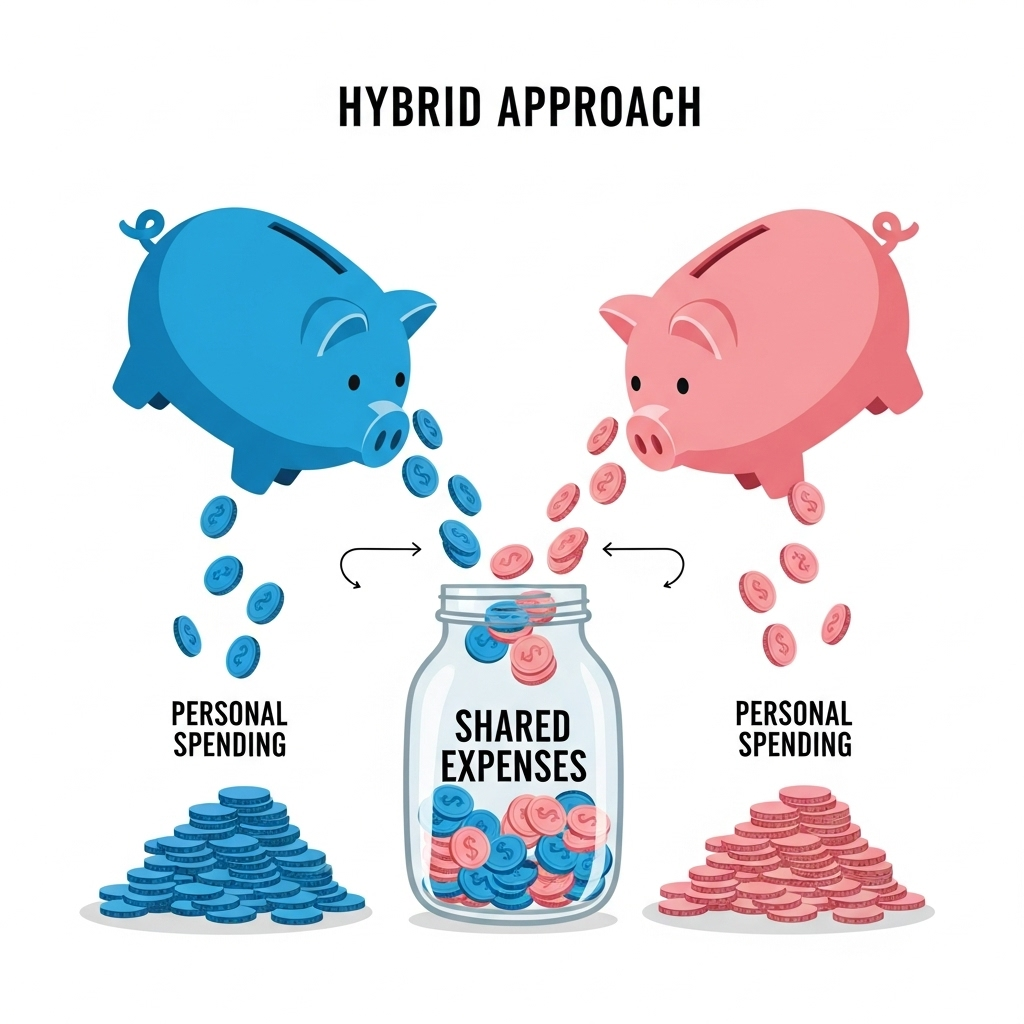

The Three Main Approaches to Merging Finances

Fully Combined: All income goes into a joint account, and all expenses are paid from it. (Works best for couples with similar spending habits and a high level of trust.)

Fully Separate: Each partner manages their own money and splits shared expenses. (Often leads to less transparency and less efficient joint saving.)

Hybrid Approach (Recommended): A joint account for all shared bills (rent/mortgage, utilities, groceries) funded by a proportional contribution from each person. Each partner keeps a separate account for personal spending (hobbies, clothes, lunch out).

4(a) Implement the 50/30/20 Rule for Clarity

A great starting point for any budget is the 50/30/20 rule

- 50% to Needs (Housing, Groceries, Transportation, Minimum Debt Payments)

- 30% to Wants (Entertainment, Dining Out, Hobbies, Vacations)

- 20% to Savings and Debt Payoff (Emergency Fund, Retirement, Extra Debt Payments)

4(b) The Financial Priority Checklist

Follow this order to maximize your financial security and growth:

✅ Step 1: Foundation & Safety

- Create an Emergency Fund (3–6 months of expenses)

- Get Health Insurance (family floater/individual as needed)

- Secure Life Insurance (preferably term plan, based on income & liabilities)

- Ensure Critical Illness / Disability Insurance coverage

✅ Step 2: Debt Management

- List all debts (educational loan, personal loan, credit card, etc.)

- Pay off high-interest debt (like credit cards, personal loans) first

- Restructure or refinance loans if beneficial

- Avoid unnecessary new debt

✅ Step 3: Goal Planning

- Short-term goals (0–3 years) → Emergency fund, vacation, vehicle purchase

- Medium-term goals (3–7 years) → Home purchase, children’s education

- Long-term goals (7+ years) → Retirement, wealth creation, legacy planning

- Prioritize goals with timelines & target amounts

✅ Step 4: Investments & Wealth Building

- Begin Systematic Investment Plans (SIPs) in equity/debt mutual funds

- Allocate assets as per risk profile & goals

- Maintain diversified portfolio (equity, debt, gold, real estate, etc.)

- Review and rebalance portfolio yearly

✅ Step 5: Retirement Planning

- Estimate required retirement corpus (based on lifestyle & inflation)

- Invest in long-term growth assets (equity mutual funds, NPS, etc.)

- Ensure retirement plan is independent of children/family support

✅ Step 7: Review & Adjust

- Review financial plan at least once a year

- Adjust for income changes, new goals, or life events

- Stay updated on tax rules & investment options

⚡ Tip: Follow the “Protection → Debt → Goals → Investments → Retirement → Legacy” sequence. It ensures your financial journey is stable, protected, and growth-oriented

Final Thoughts

Even with a modest income, young couples can build a secure and prosperous future. The key lies in:

- Protecting with insurance

- Managing expenses wisely

- Investing in short, medium, and long-term goals

- Staying disciplined and consistent

💡 Remember: Wealth creation is not about how much you earn, but how consistently you save and invest.

👉 Start today—the best time to invest was yesterday, the second-best time is NOW!

To conclude

Financial planning isn’t a “set it and forget it” task; it’s an ongoing process. Commit to having a quarterly money meeting to review your budget, check your progress on goals, and make adjustments for any changes in income or expenses.

By making communication and collaboration your top priority, you won’t just build a strong financial portfolio—you’ll build a stronger relationship.

📞 Take the first step now—contact us today and let’s create your personalized financial roadmap to wealth and security.