A Guaranteed Income Plan is a financial product designed to provide a steady stream of income for a specified period or for the rest of your life. It’s commonly used as a tool for retirement planning or to ensure financial stability during certain life stages.

Investors seek stable long-term investment options to avoid short-term market volatility. With the recent drop in fixed deposit interest rates, guaranteed income plans offer a higher return on investment, ranging from 6% to 6.5%, and protection against market risks for 40-45 years, ensuring investors’ savings are protected against unpredictable markets.

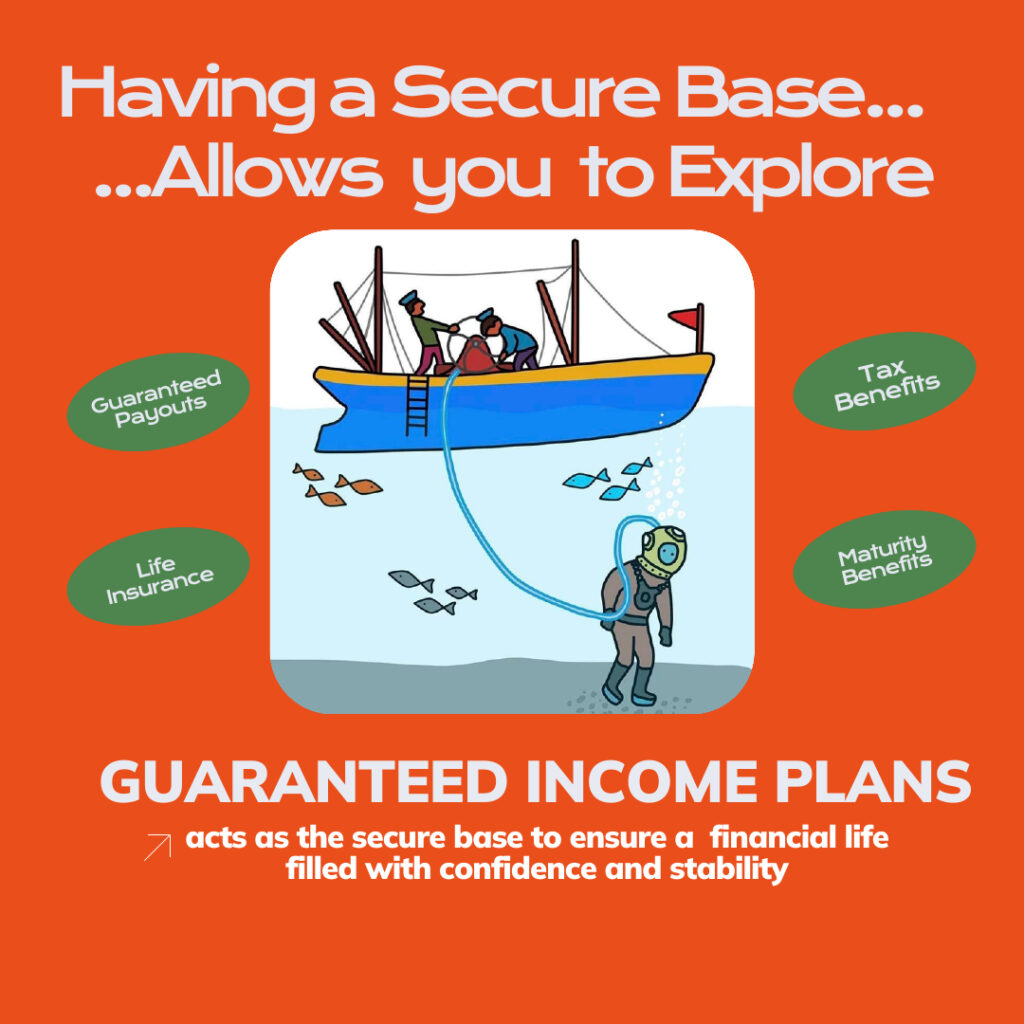

Why Guaranteed Income Plan

When comparing choices, we focus on the specified rate of return while neglecting the factors that affect the real value of money. Inflation and taxation are factors which impact the real rate of return.Another major consideration is interest rate volatility. The interest rate on bank FDs has declined from 9% to almost 5% over the previous decade, and as the economy grows, this rate may even fall. This decline will have a long-term negative impact on the financial goals you have set. Inflation, and taxation on earnings from investments like bank fixed deposits, would reduce your funds. This is where the Guaranteed Income Plan comes in.

When considering guaranteed return schemes, we should consider a minimum of 20-25 years. However, there are Guaranteed Return Plans which provide customers greater flexibility in pay-outs and investment factors. Guaranteed return plans are popular for allowing investors to lock in interest rates for a longer period of time. However, these plans allow for early withdrawals. You receive pay-outs for longer terms from the next year of the payment term. In some plans it starts even from the next month of the first payment. You also have the option of surrendering the plan in accordance with the plan terms

Guaranteed Income programs include a life insurance component as well. This option will provide a safety net for your dependents after your death. Most plans provide a life insurance of ten times the annual premium. You can also add riders to enhance your safety.

Guaranteed return plans provides a better consistent return while protecting your original investment. Hencethey are a wonderful doorway for reinvestment because they provide a long-term guaranteed flow of money.The rates here will not change, inside the same contract, unlike with provident funds or public provident funds. Banks allow fixed deposits for ten years, but these schemes offer 45 years of investment with a stable interest rate, unlike other instruments. This guarantees a longer, safer, and more productive period for your investment.

You can invest as early as possible to maximize your returns and comfortably navigate through life’s milestones. You also have the option of investing in an income plan and receiving recurrent income, or you can choose a lump sum benefit plan.

5 reasons why you need a Guaranteed Income plan

- During retirement, the pay-outs can serve as your principal source of income – The Pay-outs from a guaranteed income plan can replace one’s principal income and enable them fulfill their basic needs without financial stress.

- You can cover any additional future expenditure – Your current income may be sufficient to fulfill your needs, but there may be future expenses to consider. One can incur debts that must be repaid, as well as medical bills and other financial commitments. A guaranteed income plan may assist in establishing a source of extra income to cover these additional expenses.

- Customize the plan and its pay-outs- To achieve your life goals – You can select the premium payment term, payment mode, and income pay-out period. In some income plans, you can even choose to defer pay-outs for a specified number of years, allowing the income amounts to better match your needs.

- The costs of living are rising – Inflation is another reason why you might require an income strategy. With the cost of living continually rising, your regular expenses will rise with time, even if you do not spend on other sorts of spending. And this is where receiving payments from an income plan can be very beneficial.

- The market might be unpredictable – Other market-related investments, such as equities or equity funds, may be included in your portfolio. However, these investments carry a significant level of risk. A guaranteed income plan, on the other hand, eliminates these market-related concerns because benefits are guaranteed from the start.

To conclude: A guaranteed income plan can help you achieve long-term financial security. It provides security and an easy way to make a consistent income. The additional benefit of this financial product is that the income obtained is tax-free under Section 10(10D) of the Income Tax Act of 1961, subject to the conditions specified therein. So, you earn tax-free benefits that are guaranteed to help you retain your standard of living over the years.

If you find a guaranteed income plan aligns with your requirements, feel free to contact us. We offer an extensive range of plans and will help you discover the best one tailored to your need.