Are you drawn to the prospect of investing yet are concerned by the financial sector? SIPs, or systematic investment plans, can be the ideal place to start. We’ll explain what SIPs are, how they operate, and present some simple examples in this beginner-friendly guidance to assist you get started with investing.

WHAT ARE MUTUAL FUNDS?

A mutual fund is a collective investment vehicle that collects and pools money from multiple investors and invests it in shares, bonds, government securities, and money market instruments.

Professional fund managers spend the money collected in mutual fund schemes in stocks and bonds, among other things, based on the scheme’s investment objective. The income / gains created by this collective investment scheme are dispersed equally among the investors after deducting appropriate expenses and taxes, using a scheme’s “Net Asset Value” or NAV. In return, mutual funds levy a nominal fee.

In a nutshell, a mutual fund is a pool of money supplied by multiple investors and managed by a professional fund manager.

Understanding SIPs

SIPs, or systematic investment plans, are a disciplined and hassle-free way to invest in mutual funds. SIPs enable you to invest a set amount on a recurring basis, usually monthly, instead of to making a lump sum commitment. This approach helps in rupee cost averaging in addition to promoting financial discipline.

How SIPs Work

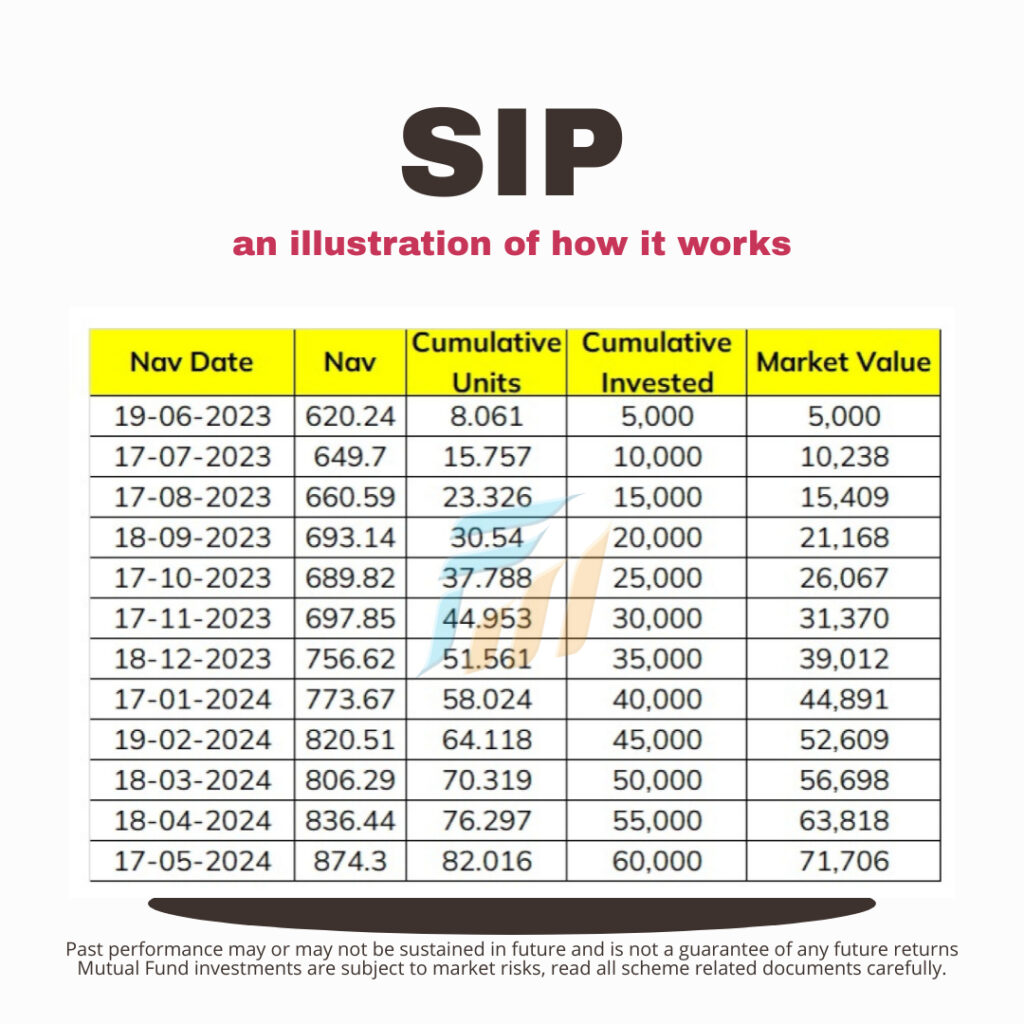

Let’s illustrate this with an example:

Suppose you decide to invest ₹5,000 every month in an equity mutual fund through SIPs. Here’s how it works:

Month 1: You invest ₹5,000 when the NAV (Net Asset Value) of the mutual fund is ₹620.24. So, you’ll get 8.061 units (₹5,000 ÷ ₹620.24).

Month 2: The NAV is ₹649.7. Now, your ₹5,000 will fetch you approximately 7.69 units (₹5,000 ÷ ₹649.7).

Month 3: The NAV is ₹660.59. You’ll now get around 7.569 units (₹5,000 ÷ ₹660.59).

This process continues over time, and you keep accumulating units at different NAVs.

Benefits of SIPs

1.Rupee Cost Averaging

Rupee Cost Averaging is an investment strategy that involves investing a fixed amount over time, regardless of market conditions. This strategy smooths out market volatility by buying more units when prices are low and fewer during high prices. This disciplined approach reduces overall risk and enhances long-term returns, focusing on consistency of contributions rather than market timing.

2. Disciplined Investment Approach

Systematic Investment Plans (SIPs) are a disciplined investment approach that encourages consistent saving and investment, despite market fluctuations. The automated nature of SIPs ensures an uninterrupted and systematic process, fostering a sense of financial discipline and enabling long-term financial goals.

3. Power of Compounding

Starting early and staying invested for the long term allows the power of compounding to work its magic.

Let’s consider two investors, A and B:

Investor A starts a SIP of ₹5,000 per month at the age of 25 and continues until 60, earning an average return of 12% per annum. Investor B starts a SIP of ₹5,000 per month at the age of 35 and continues until 60, earning the same average return of 12% per annum.

At the age of 60:

Investor A’s investment would have grown to approximately ₹3.82 crores.

Investor B’s investment would have grown to approximately ₹1.26 crores.

How to Start a SIP

- Set Your Financial Goals: Determine why you’re investing and what you aim to achieve.

- Choose the Right Mutual Fund: Select a fund based on your risk appetite, financial goals, and investment horizon.

- Complete KYC: Complete your Know Your Customer (KYC) formalities with the chosen mutual fund house

- Start Investing: Fill out the SIP form, specifying the amount you want to invest and the frequency (usually monthly).

- Monitor and Review: Keep track of your investments regularly and make adjustments if needed.

Conclusion

SIPs offer a simple and effective way for beginners to enter the world of investing. By investing regularly over time, you can potentially build substantial wealth and achieve your financial goals. Remember, consistency and patience are key. Start your SIP journey today, and watch your money grow! Call us to learn more

Contact Us to take an informed decision

Whether your aspirations are small or grand, we will help you create a straightforward strategy that will help you achieve that. We can help you manage your wealth through each stage of the financial planning lifecycle to ensure you get the most out of your finances and your life be it