Investing in mutual funds is a strategic way to grow your wealth, but it requires careful planning and consideration. Financial planning is the foundation for making informed investment decisions that align with your long-term goals. Whether you’re saving for retirement, purchasing a home, or funding education, setting clear financial goals is essential. Let’sl explore key aspects of financial planning in the context of mutual fund investments, like the importance of goal-setting, assessing risk tolerance, diversifying your portfolio, and more. By understanding and implementing these principles, you can optimize your mutual fund investments, manage risks effectively, and stay on track to achieve your financial aspirations.

Goal-setting is a crucial aspect of financial planning, especially when it comes to mutual fund investments. It provides a clear roadmap for investment decisions and tactics, guiding investors towards saving for retirement, buying a house, or paying for school. By selecting mutual funds that align with investors’ time horizons and risk tolerances, investors can ensure a disciplined approach and maximize returns on mutual fund investments, aligning returns with risk management.

Assessing your risk tolerance is crucial in financial planning, especially when investing in mutual funds. It refers to your willingness to endure market fluctuations and potential losses for financial gains. Understanding your risk tolerance helps you choose the right mutual funds, ranging from conservative funds like bond or money market funds for low risk to equity or sector-specific funds for high risk.

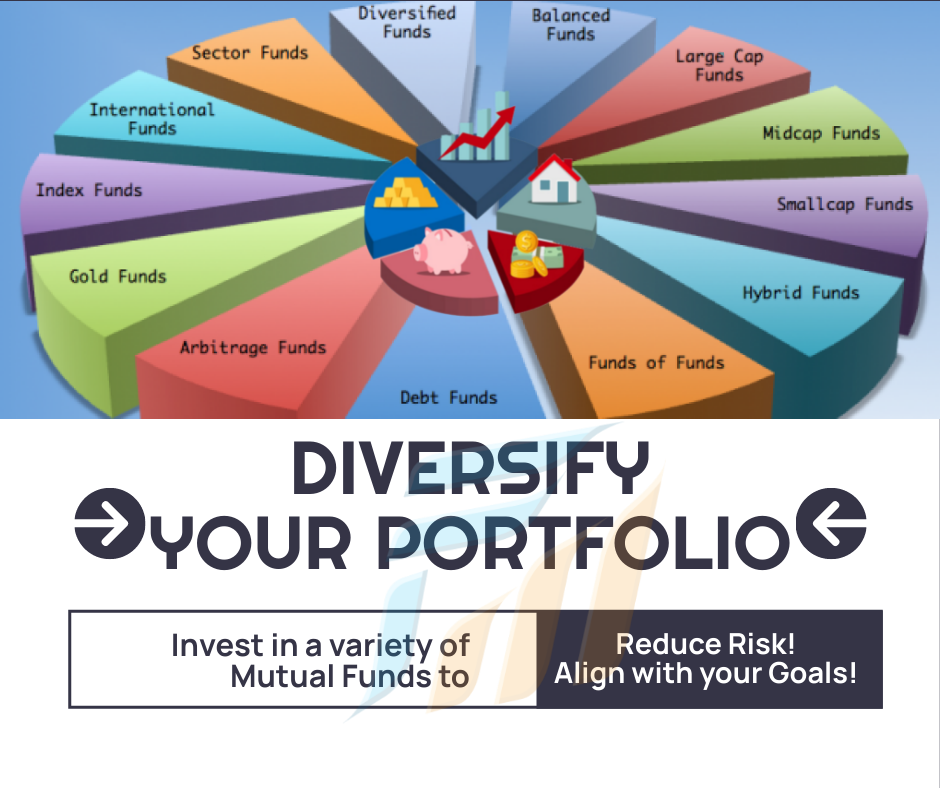

Diversification involves spreading investments across different asset classes, sectors, and geographic regions to reduce risk. Mutual funds are an excellent vehicle for diversification, as they pool money from multiple investors to invest in various securities like stocks and bonds. This strategy helps mitigate the impact of poor performance in one investment, stabilize returns over time, reduce the risk of significant financial loss, and enhance the potential for achieving long-term financial objectives. Diversification within mutual funds effectively balances risk and reward, making it a vital part of a robust financial plan.

Starting early in mutual funds is a powerful financial planning strategy due to the power of compounding. This allows your money to grow over time, taking advantage of market growth and short-term volatility. Early investments also allow you to contribute smaller amounts regularly, reducing the pressure of large lump-sum investments later. Even modest investments can accumulate substantial wealth, helping you reach long-term financial goals like retirement or home buying. Starting early maximizes the benefits of mutual fund investing, offering higher returns and greater financial security in the future.

Staying invested in mutual funds is crucial for financial planning due to the volatility of markets. These funds are designed for gradual wealth accumulation, allowing portfolios to recover from temporary losses and benefit from future gains. This long-term approach smooths out volatility, leveraging rupee cost averaging to lower the average purchase cost over time. Additionally, remaining invested allows for full capitalization on compounding returns, which are essential for building wealth over time. By staying the course during market ups and downs, you are more likely to achieve your financial goals and maximize the potential of your mutual fund investments.

Reviewing investments on a regular basis is essential for financial planning, particularly with mutual funds. Changes are necessary over time due to the ever-changing nature of both personal circumstances and financial markets. Periodic reviews assist in evaluating the performance of mutual funds, ensuring that they meet financial objectives, and keeping oneself updated on market trends, fund performance, and fees. Consistent rebalancing of the portfolio guarantees diversification and aligns asset allocation with current financial goals. Frequent reviews help to maximize investment strategies, make well-informed decisions, and guarantee that mutual funds are used to meet long-term financial objectives.

A financial advisor is essential for financial planning, particularly when investing in mutual funds. They can help navigate the complex investment landscape, offering personalized advice, selecting the right mix of mutual funds, and offering strategies for portfolio diversification, tax efficiency, and retirement planning. Their expertise ensures that your investment plan adapts to changes in your life circumstances or financial goals. Working with a financial advisor can help avoid common pitfalls, optimize your investment strategy, and enhance your chances of long-term success in achieving financial objectives through mutual funds.

In conclusion, successful mutual fund investing involves disciplined financial planning, including setting clear goals, understanding risk tolerance, diversifying portfolios, and starting early. Despite market fluctuations, staying committed, regularly reviewing investments, and seeking professional advice enhances the ability to navigate financial complexities. These practices not only maximize returns but also manage risks effectively, ensuring mutual fund investments support long-term financial success.