In today’s fast-paced world, securing your financial future is more critical than ever. You might have heard the term “SIP” or Systematic Investment Plan, and wondered what it’s all about. Here, we’ll delve into the world of SIP, exploring how it can be a powerful tool in your journey towards wealth creation and financial security.

Understanding SIP

SIP is a disciplined approach to investing in mutual funds. It allows you to invest a fixed amount regularly, typically on a monthly basis, in a mutual fund scheme of your choice. This approach has several key advantages that can significantly impact your wealth creation journey.

SIP for Long-term Wealth Creation

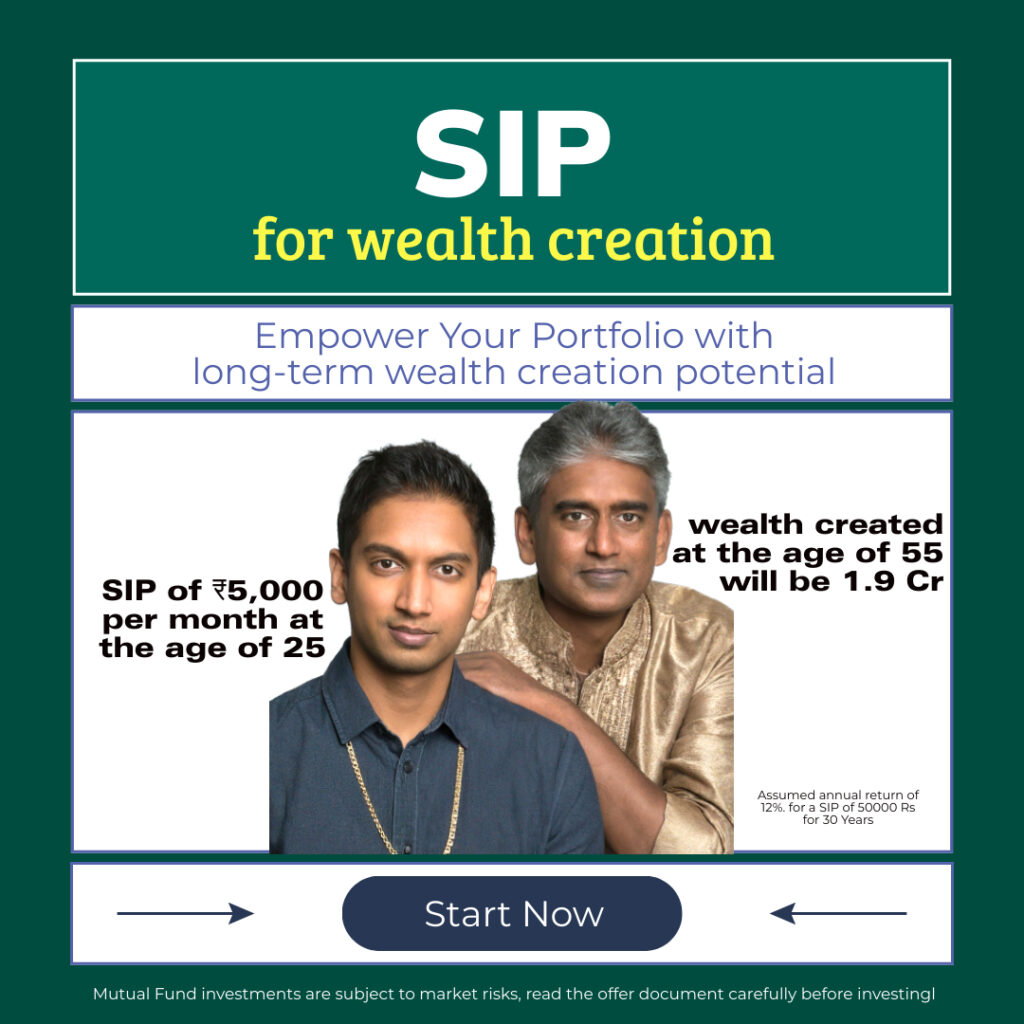

One of the most remarkable aspects of SIP is its long-term wealth creation potential. Let’s consider a scenario:

Suppose you start a SIP of ₹5,000 per month at the age of 25 and continue it for 30 years, earning an average annual return of 12%. By the time you’re 55, you’d have invested ₹18,00,000, but your investment could potentially grow to approximately ₹1.9 crores! That’s the power of disciplined, long-term investing with SIP.

Benefits of SIP in Investment

Rupee Cost Averaging

SIP allows you to buy more units when prices are low and fewer when prices are high. Over time, this evens out your average cost per unit, reducing the impact of market volatility on your investments.

Disciplined Investing

SIP enforces financial discipline. By investing a fixed sum each month, you avoid impulsive decisions and invest regularly, which is key to building wealth.

Power of Compounding

Compounding is the magic ingredient that makes SIP so effective. Your returns from the invested amount get reinvested, generating more returns, which, over time, can lead to significant wealth accumulation.

Accessibility

SIPs are accessible to a wide range of investors. You can start with a relatively small amount and increase your investment as your income grows

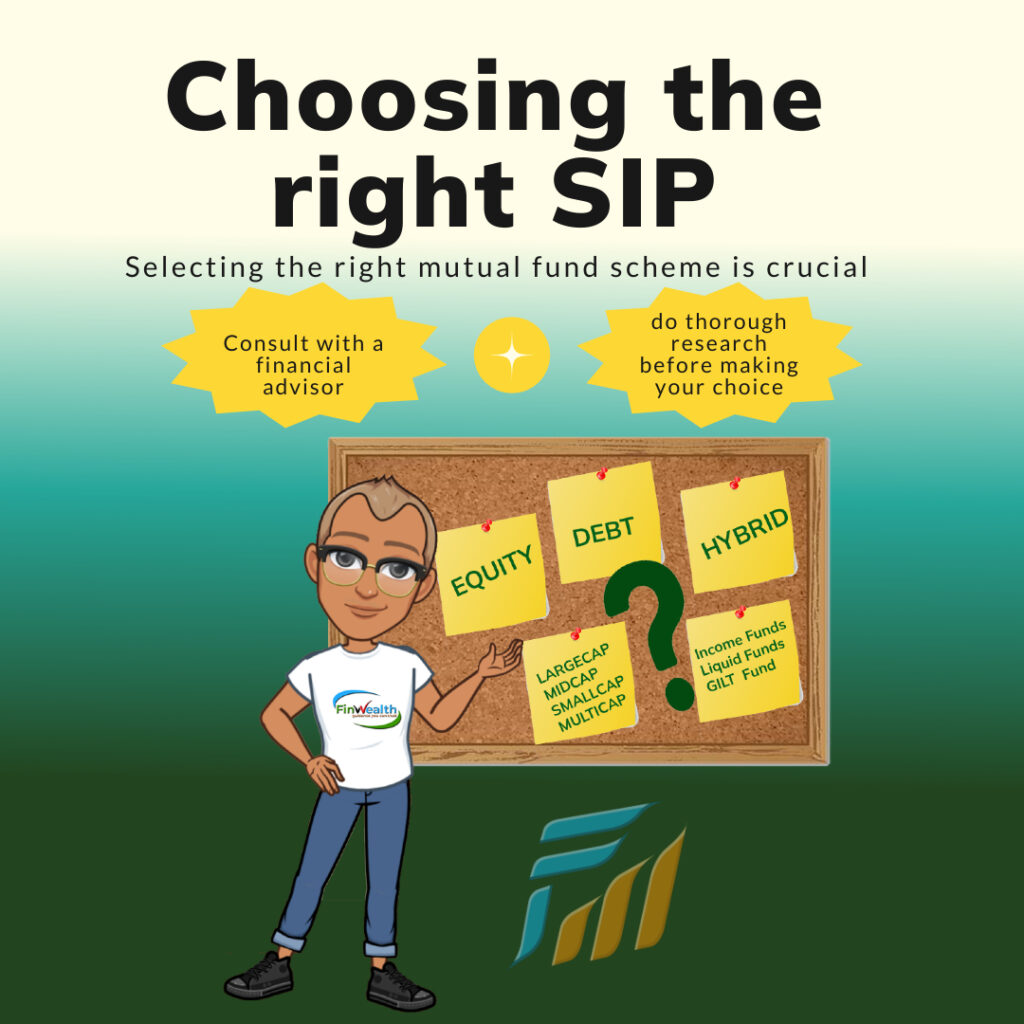

Choosing the Right SIP

Selecting the right mutual fund scheme is crucial. Factors like your financial goals, risk tolerance, and investment horizon play a significant role. Consult with a financial advisor or do thorough research before making your choice

SIP is not a get-rich-quick scheme, but rather a disciplined, systematic approach to wealth creation. It aligns perfectly with the age-old wisdom of “slow and steady wins the race.” By starting early, being consistent, and making informed choices, you can harness the full potential of SIP in investment and embark on a successful journey towards financial security and wealth creation.

So, start your SIP today and watch your wealth grow, inch by inch, on the path to financial freedom and prosperity. Remember, wealth creation is not an overnight process, but it is certainly within your reach through the power of SIP