In personal financial management, achieving financial stability and growing wealth requires more than just saving diligently. One of the most crucial strategies for optimizing returns and managing risk is asset allocation. Asset allocation refers to the process of dividing investments across different asset classes—such as stocks, bonds, real estate, and cash equivalents—based on an individual’s financial goals, risk tolerance, and investment horizon.

Why Asset Allocation Matters

1. Risk Management

Different assets carry different risks: stocks offer high potential returns with unpredictability, while bonds bring stability but lower returns. Diversifying across assets minimises impact from weak areas, balancing market fluctuations and shielding investments in tough times for better chance at financial goals.

2. Maximizing Return Potential

A well-balanced portfolio allows you to benefit from the growth potential of higher-risk assets while also protecting your investments with lower-risk options. When the markets are strong, stocks can deliver substantial returns. In times of economic uncertainty, safer investments like bonds and cash can help preserve your capital. This combination helps you maximize returns while minimizing the risk of high volatility across your entire portfolio.

3. Customising Based on Financial Goals

Financial goals are unique to each individual. For example, a young professional saving for retirement might prioritize growth, while someone approaching retirement may focus on preserving their capital. Asset allocation is a strategy that helps you customise your investments to align with your specific financial objectives. Young investors can take more risks due to time, while shorter timeframes favor conservative portfolios.

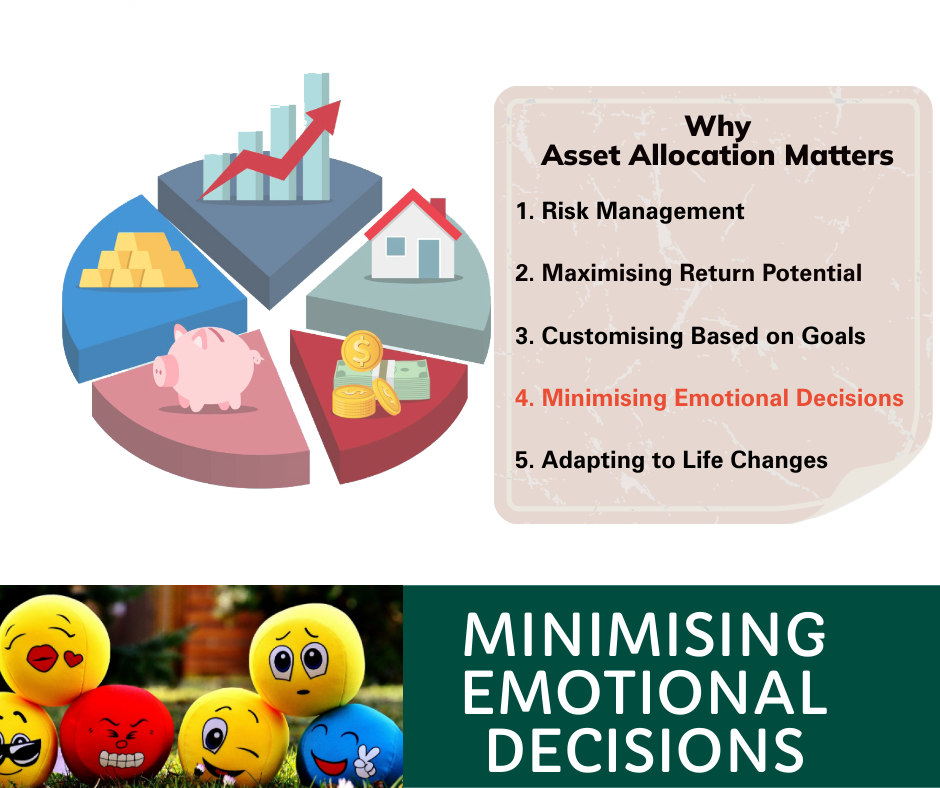

4. Minimising Emotional Investment Decisions

One of the biggest challenges in investing is staying disciplined during market fluctuations. Without a solid asset allocation strategy, investors might feel pressured to chase quick profits or panic during market declines, which can result in poor choices. A well-defined asset allocation plan serves as a guide, helping investors stay focused on their long-term goals and minimising emotional responses that could disrupt their financial plans.

5. Adapting to Life Changes

Your asset allocation shouldn’t stay the same; it should change as your financial situation evolves. For example, as you near important goals like buying a home, saving for college, or retiring, you may want to adjust your portfolio to include more conservative investments. This flexible strategy helps keep your portfolio in line with your changing needs and objectives

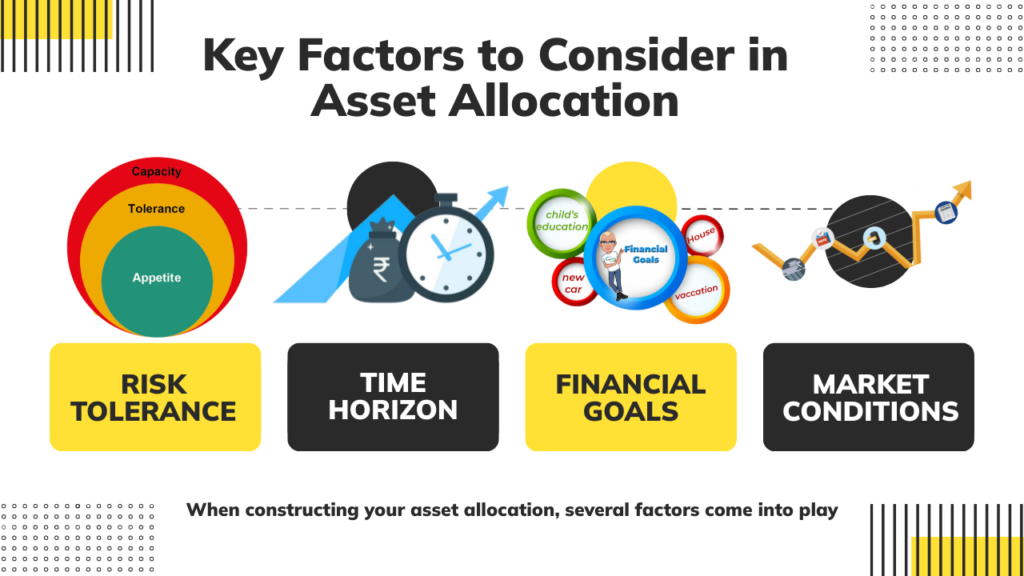

Key Factors to Consider in Asset Allocation

Risk Tolerance:

How much risk are you comfortable taking? Are you ready to accept short-term losses for the chance of long-term gains, or do you prefer more stable but modest growth?

Time Horizon:

How long do you plan to keep your money invested? A longer investment period usually permits taking on more risk, while a shorter timeframe calls for a more cautious approach

Financial Goals:

What are you saving for—retirement, a new home, or your child’s education? Your specific goals will determine the right mix of investments for you.

Market Conditions:

It’s essential to stick to your long-term strategy, but regularly reviewing your portfolio in response to significant market changes can also be helpful.

Strategies for Asset Allocation

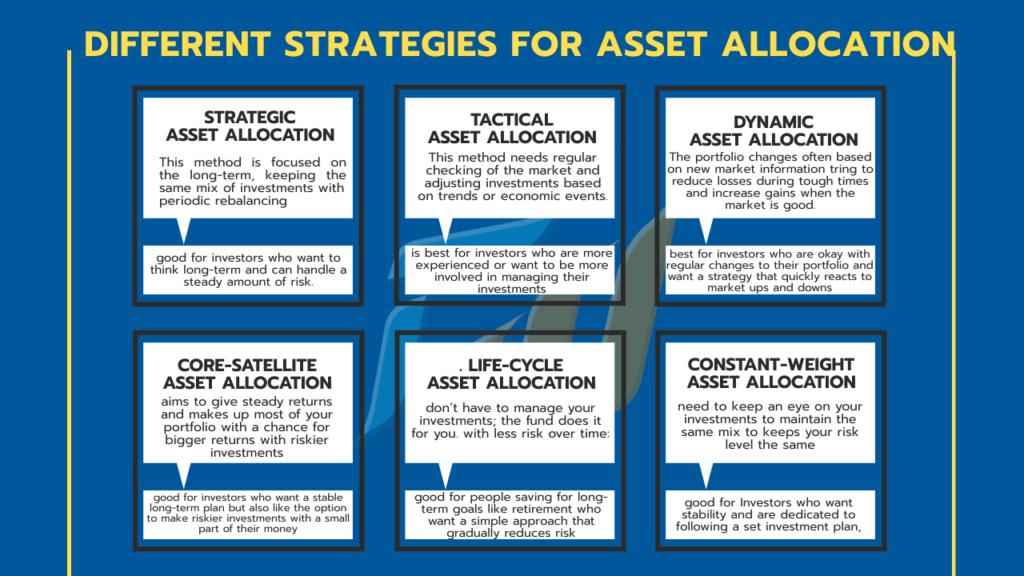

1. Strategic Asset Allocation

Strategic Asset Allocation is a common method used in managing personal finances. This method means choosing how much of your money to put into different types of investments based on your long-term goals and how much risk you can handle. For example, you might choose to invest 60% in stocks, 30% in bonds, and 10% in cash. Once you make this choice, you keep this mix over time, no matter what happens in the market.

Key Features

Long-term Focus: This method is focused on the long-term, keeping the same mix of investments.

Periodic Rebalancing: Since the value of investments can change, you need to adjust your mix sometimes. For example, if stocks grow and make up more than 60% of your portfolio, you would sell some stocks and buy bonds or cash to get back to your original plan.

This strategy is good for investors who want to think long-term and can handle a steady amount of risk. They like to set their plan and only make adjustments every now and then.

2. Tactical Asset Allocation

Tactical Asset Allocation is a more active way to invest that aims to take advantage of short-term market chances. In this method, the investor starts with a basic plan for their investments but makes temporary changes based on market situations. For example, if you think stocks are cheap, you might raise your stock investment to 70% for a short time, hoping to make quick profits.

Key Features:

Active Management: This strategy needs regular checking of the market and adjusting investments based on trends or economic events.

Higher Risk and Reward: Tactical allocation can lead to bigger profits if the market behaves as expected, but it also comes with the risk of making wrong choices.

This is best for investors who are more experienced or want to be more involved in managing their investments and are okay with taking on more risk for the chance of higher rewards.

3. Dynamic Asset Allocation

Dynamic Asset Allocation changes investments regularly based on market conditions. Unlike tactical allocation, which changes investments at set times, dynamic allocation is always adjusting the mix of assets according to economic changes. For example, during a recession, an investor may invest more in bonds and cash to protect their money, and then move back to stocks when the economy gets better.

Key Features:

Constant Adjustment: The portfolio changes often based on new market information.

Proactive Risk Management: This strategy tries to reduce losses during tough times and increase gains when the market is good.

Investors who are okay with regular changes to their portfolio and want a strategy that quickly reacts to market ups and downs.

4. Core-Satellite Asset Allocation

Core-Satellite Asset Allocation means splitting your investment portfolio into two parts: the “core” and the “satellite.” The core part is stable and made up of low-cost, widely spread investments, like index funds. The satellite part is riskier and includes things like individual stocks or funds that focus on specific sectors.

Key Features:

Diversified Core: This part aims to give steady returns and makes up most of your portfolio.

High-Reward Satellite: This part has the chance for bigger returns with riskier investments.

It’s good for investors who want a stable long-term plan but also like the option to make riskier investments with a small part of their money.

5. Life-Cycle or Target-Date Asset Allocation

This plan is great for people who want their investments to change as they get older. In Life-Cycle Asset Allocation, the investment mix becomes safer as you get closer to retirement or a big money goal. This is usually done with target-date funds that shift from riskier options (more stocks) to safer ones (more bonds and cash) as the target date approaches.

Key Features:

Automatic Changes: You don’t have to manage your investments; the fund does it for you.

Less Risk Over Time: The investments become safer as you near the time you need the money, lowering the chance of losing a lot of money later on.

People saving for long-term goals like retirement who want a simple approach that gradually reduces risk.

6.Constant-Weight Asset Allocation

In Constant-Weight Asset Allocation, you keep the same mix of investments no matter what happens in the market. For example, if you decide on 50% stocks and 50% bonds, you will regularly adjust your investments to keep this mix, even if one type of investment does much better than the other.

Key Features:

Regular Adjustments: You need to keep an eye on your investments to maintain the same mix.

Steady Approach: This keeps your risk level the same and helps you avoid reacting emotionally to market changes.

Investors who want stability and are dedicated to following a set investment plan, no matter what the market does.

Conclusion

Choosing how to split your investments depends on your money goals, how much risk you are okay with, how long you want to invest, and how much you want to manage your investments. Whether you want to be very involved, not involved at all, or somewhere in between, how you divide your money is important for growing your wealth and ensuring your financial future. The key is to understand your own financial situation and choose a plan that matches your long-term goals.